Studentfunding: Unlocking the Secrets to Educational Support

Anúncios

Effectively managing student funds involves creating a budget, tracking expenses, and saving for unexpected costs to ensure financial stability throughout college.

Studentfunding plays a crucial role in making higher education accessible for many. With various options available, understanding them can be overwhelming. Have you ever wondered what the best path is for your financial journey?

Anúncios

Understanding student funding options

Understanding the various student funding options available is essential for anyone looking to pursue higher education. With a multitude of choices, it can be overwhelming to figure out which path to take. Knowing the different types of funding can help you make informed decisions.

Types of Student Funding

There are several options that students can explore. Here are the main categories:

- Grants: These are usually based on financial need and do not require repayment.

- Scholarships: These are merit-based and also do not need to be repaid.

- Loans: These funds must be repaid with interest and can be from private or federal sources.

- Work-Study Programs: These provide part-time jobs to students to help pay for education-related expenses.

Applying for student funding can vary by type. For grants and scholarships, students typically need to submit an application that demonstrates eligibility based on financial need or academic achievement. On the other hand, loans may require a credit check and would typically involve filling out additional paperwork.

Anúncios

Where to Find Funding

Many students often ask where to find these funding opportunities. There are numerous resources available, including:

- University financial aid offices

- Online scholarship databases

- State and federal student aid programs

- Local community organizations

Additionally, networking among peers and reaching out to teachers can provide valuable insights and leads. By utilizing these resources, students can gain access to the funds they need to support their educational goals.

Understanding student funding options is not just about knowing where to apply, but also about recognizing the importance of these resources in reaching your academic dreams. Taking the time to research and evaluate all available options can lead to a more financially secure future in education.

Grants vs. loans: what’s the difference?

When considering student funding, it’s important to understand the differences between grants and loans. Both are common ways to help pay for education, but they come with different rules and responsibilities.

Grants Explained

Grants are funds that do not need to be repaid. They are often awarded based on financial need, making them a valuable resource for students from low-income families. Many grants are funded by the federal government or specific state organizations.

Some common types of grants include:

- Pell Grants: Available to undergraduate students who demonstrate financial need.

- Federal Supplemental Educational Opportunity Grants (FSEOG): Offered to students with exceptional financial need.

- State Grants: These vary by state, providing funds to residents attending school in their state.

Understanding Loans

In contrast, loans must be repaid over time, often with added interest. They can be a necessary tool if grants and scholarships do not cover all educational costs. There are two main types of student loans: federal and private.

Here are some key features of loans:

- Federal Loans: Generally have lower interest rates and better repayment options.

- Private Loans: Offered by banks and private institutions, often require a credit check.

- Interest Rates: Can be fixed or variable, impacting total repayment amounts.

Understanding whether you prefer grants or loans depends on your financial situation. Grants are ideal for those who qualify; however, students often have to rely on loans to finance their education fully. Careful consideration of both options can help you make the best decision for your financial future.

How to apply for student funding successfully

Applying for student funding can seem daunting, but knowing the right steps can make the process easier. Whether you are seeking grants, loans, or scholarships, understanding how to navigate these applications is crucial.

Prepare Your Documents

The first step in applying for funding is gathering the necessary documents. This typically includes:

- Your free application for federal student aid (FAFSA) form.

- Tax returns from the past year.

- A list of schools you are considering.

- Proof of any income or benefits.

Having these documents ready will streamline the process and help ensure you don’t miss any crucial steps.

Understand the Application Process

Each type of funding has its own application process. For federal loans and grants, you will start by filling out the FAFSA, which determines your eligibility based on financial need. Scholarships often require separate applications, which may include essays, letters of recommendation, or interviews.

Pay close attention to deadlines. Many scholarships and grants have specific submission dates, and missing them can mean losing out on funding.

Follow Up and Stay Organized

Once you submit your applications, it’s important to stay organized. Keep a checklist of the funding sources you applied to, along with their deadlines and requirements. Regularly check the status of your applications to ensure that you don’t miss any important communications.

By following these steps and preparing ahead of time, you can significantly increase your chances of securing the funding you need for your education. With careful organization and an understanding of the process, the path to student funding can be much smoother.

Scholarships: where to find the best opportunities

Finding the right scholarships can greatly reduce the financial burden of higher education. There are numerous resources and strategies to help you locate the best opportunities available.

Online Scholarship Databases

One of the most effective ways to search for scholarships is through online databases. These platforms compile numerous scholarship opportunities all in one place. Some popular databases include:

- Fastweb: Personalized scholarship matches based on your profile.

- Scholarships.com: A comprehensive site with many listings.

- Cappex: Allows you to find scholarships and connect with colleges.

These resources can help put you in touch with a wide range of scholarships that align with your qualifications.

School and Community Resources

Your school’s financial aid office is another crucial resource. They often have information on scholarships specific to your institution. Additionally, community organizations, such as local charities or service organizations, may offer scholarships as well.

High schools frequently host workshops or provide materials to assist students in applying for scholarships. Involving teachers and counselors in your search may yield valuable local opportunities that are less competitive.

Networking and Personal Connections

Networking can also be a powerful tool in finding scholarships. Talking to family members, friends, or alumni can uncover opportunities that may not be widely advertised. In addition, consider joining local clubs or organizations that focus on education, as they may offer scholarships to members.

By combining these methods and regularly checking for new opportunities, you can enhance your chances of securing a scholarship that will help finance your educational journey.

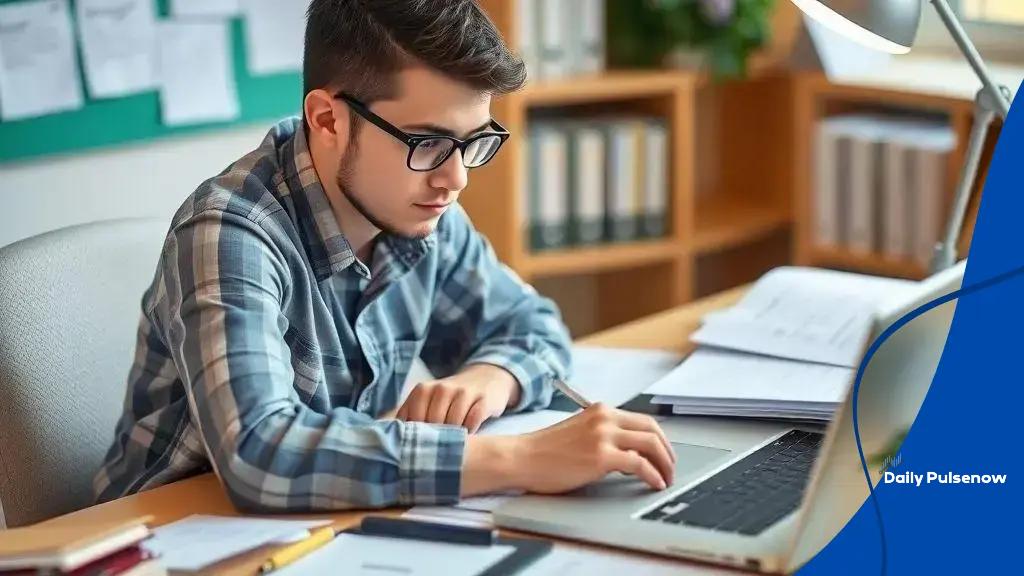

Managing student funds effectively

Managing student funds effectively is crucial for success in college. Making the most of your financial resources can help reduce stress and ensure you can focus on your studies. Understanding how to budget and track your expenses is the first step.

Creating a Budget

The foundation of managing your funds is creating a budget. Start by listing all sources of income, which may include student loans, grants, scholarships, and part-time jobs. Next, outline your monthly expenses:

- Tuition and fees: These are your primary costs each semester.

- Housing: Rent, utilities, and related expenses.

- Food: Groceries and snacks.

- Transportation: Costs for public transit or gas for your car.

Once you have your income and expenses mapped out, you can see where you stand financially. Adjust your spending to ensure your needs are met without overspending.

Tracking Expenses

Regularly tracking your expenses is just as important as budgeting. By monitoring your spending habits, you can identify areas where you might cut back. Use apps or personal finance tools to help you keep a close eye on your transactions. Some popular apps include:

- Mint: A comprehensive budgeting tool that connects to your bank accounts.

- YNAB (You Need A Budget): Helps you allocate every dollar you earn.

- GoodBudget: A digital envelope system for tracking cash flow.

Every little bit helps, and learning to manage student funds wisely can lead to healthier financial habits that last beyond your college years.

Saving for Future Expenses

Even while focusing on day-to-day expenses, it’s wise to set aside money for future costs. Unexpected expenses can arise, and having a savings buffer can alleviate potential stress. Consider allocating a small portion of your monthly funds to a savings account. This can be used for emergency situations or future educational costs.

By being proactive about managing your funds, you can ensure that you will have the financial resources to enjoy your college experience.

Managing your student funds effectively is essential for a successful college experience. By creating a budget, tracking your expenses, and saving for future goals, you set yourself up for financial success. It’s important to utilize available tools and resources to help streamline the process. Remember, staying organized and proactive can make a big difference in how you handle your finances. By implementing these strategies, you can focus more on your studies and enjoy your college life with less financial stress.

FAQ – Frequently Asked Questions about Managing Student Funds

What is the best way to create a budget for my student expenses?

Start by listing all your income sources and monthly expenses. Categorize them into essentials and non-essentials to see where adjustments can be made.

How can I track my expenses effectively?

Use budgeting apps like Mint or YNAB to monitor your spending. Regularly updating your records helps you stay on top of your financial situation.

What should I do if I have unexpected expenses?

Build an emergency savings fund by setting aside a small amount each month. This will help you cover unexpected costs without financial strain.

Are there any resources to help manage my finances?

Yes, many universities offer financial aid offices that provide tools and workshops for budgeting and financial management. Additionally, online resources can be very beneficial.